[NEW] Prospect Engagement Campaign | Tax Planning

Engage prospects who are interested in Tax Planning before the laws change!

Current tax rules can radically change your prospect’s tax picture right now.

These rules are set to expire in 2025, but they could change at any time without notice if lawmakers take action.

This new Tax Planning Prospect Campaign offers prospects a FREE Tax Reduction Opportunity Review from you.

This email-based campaign helps you engage prospects by highlighting the benefits of tax planning.

If you’ve got fresh leads from the Hidden Tax Opportunities Lead Generation Campaign, this is a perfect follow-up.

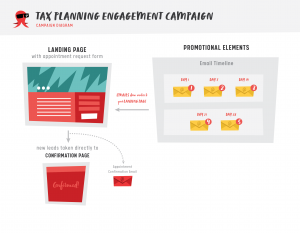

Drive prospects to a personalizable landing page that promotes a free appointment to review their tax strategies.

This campaign is designed to help you continue the conversation with prospects and brings them deeper into the awareness funnel.

The campaign publishes content over 5 weeks and includes:

- 5 emails promoting the value of your tax planning advice

- 1 appointment page where motivated leads can request a free chat with you

- 1 appointment confirmation page that points leads to your website

- 1 appointment confirmation email that confirms the request was received

More about this campaign:

Title: Tax Planning

Type: Prospect Engagement Campaign

Description: Highlight the benefits of tax planning with this email-based campaign that educates, informs, and engages prospects on your list.

Target Audience: Cold Prospects

Primary Outcome/Action: Booking an appointment.

Running Time: 5 weeks.

To find out more about how Snappy Kraken can fit into your marketing strategy, click here to see a demo.

Book A Demo Today

Discover how Snappy Kraken helps advisors grow with a powerful marketing system

Request a demo