3 Strategies For Financial Advisor Marketing Success

All you need to bake yummy peanut butter cookies is peanut butter, sugar, and an egg. Mix everything together, then throw your dough into the oven for six to eight minutes. But the entire recipe fails if you’re missing an ingredient or take the cookies out early.

Just like baking, good marketing takes good ingredients and the right amount of time. Half-baked marketing is a common problem that financial advisers face—they don’t nurture their leads long enough, they send their leads and clients generic messages, or they only use one campaign.

Luckily, we’ve got the perfect recipe for you. Marketing strategies that produce results rely on three factors: cohesive campaigns, content that resonates with your target audience, and conversations that lead to stronger relationships.

Relevant Content Improves Your Reputation

Content specialist and author Lee Odden titled chapter nine of his book, “Content isn’t king, it’s the kingdom.” That’s because content doesn’t exist in a vacuum, only for the writer or creator to enjoy—it exists to educate, invoke curiosity, and be enjoyed by everyone around the content creator.

Building your online reputation as a financial adviser only requires three types of content:

- Educational content explains a financial topic, like tax planning, in a way that almost anyone can understand. Displaying your knowledge through content builds credibility and shows leads and clients that they can trust you with their finances.

- Current content is any type of social media post or blog article that addresses a current financial or economic event that may cause financial stress. For example, when the omicron variant of COVID-19 came out, people all over the world started worrying about the effect it could have on the stock market. Addressing concerns as they arise shows your leads and clients that you’ve got their back and that you’re ready to take them through thick and thin.

omicron would affect the stock market and what they could do to prepare.

- Relationship-building content focuses on finance-adjacent topics that your leads and clients are interested in. For example, an audience that’s interested in celebrity news might enjoy content about celebrities who made money mistakes. Our latest finance-adjacent campaign focused on new years’ resolutions—we’ve found that most of our members’ clients are wellness enthusiasts and workaholics.

All three types of content will build your reputation with your clients and leads, establishing you as the go-to resource for all their financial questions.

To create relevant content, you need to get to know your “kingdom” (i.e., your target audience)—what they are interested in, what they worry about, and what they are looking for in a financial adviser. Fortunately, we’ve done the research for you:

If you still don’t believe in the power of content, Snappy Kraken member Michael Baker of Vertex Capital Advisors landed a high-net-worth (HNW) client using relevant content: “Snappy Kraken’s consistent drip of awesome content makes me look top-notch with my followers! Recently their Retirement Success campaign led me to a $1.5 MILLION client!”

Cohesive Campaigns Keep You Top of Mind

In 2015, it took six to eight marketing touches to generate a sales-ready lead—not a client, just a lead that might be close to becoming a client. Today, the sales cycle is even longer. Joe Tilton, a digital marketing strategist at The Financial Guys, told us, “The average sales funnel for the financial industry is about 6–8 months. You can’t let leads grow cold.”

Keeping leads warm means reminding them that you exist through regular follow-ups that contain relevant and interesting information. If you don’t continue following up for at least six months, they’ll forget about you and never become clients. You can keep yourself top of mind with automated marketing campaigns that send a series of related marketing messages over a period of time, across different platforms.

Snappy Kraken member Matt found that sending campaigns kept him top of mind with prospects who have been in his pipeline for years. “I just scheduled a meeting with a $1.2M prospect because of [Snappy Kraken’s campaigns],” he told us, “[The prospect] said my name kept coming up (because I’ve been emailing him since the end of 2018) and he’s finally ready to sit down and talk.”

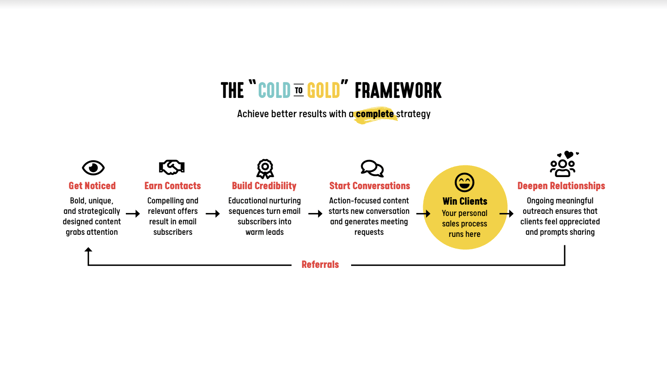

Matt used relevant content as part of his campaigns that he sent his clients and prospects over weeks and months. Messages in marketing campaigns build on one another, creating a cohesive experience that takes your lead on a journey that eventually turns them into clients. We call this the Cold to Gold Framework.

The Cold to Gold Framework is designed to generate leads and take them on a journey that shows them why they should choose you as their financial adviser. Each step in the framework has a different set of campaigns that you can send to each segment in your email list (our plug-and-play library has all the campaigns you’ll ever need). For example, we have campaigns designed to generate leads, engage prospects, and more.

Conversations Build Strong Relationships

Choosing a financial adviser isn’t like buying a pair of shoes or finding an outfit for the day. It’s a life decision that could have major financial consequences. Reliable advisers work hard to get their clients financial wins and mitigate losses. The trick is to prove you’re one of the reliable ones.

When you build your marketing campaigns with relevant content, you’re starting conversations that lead to strong adviser-client relationships with the contacts on your email list. Those conversations let you get to know your leads and clients and help you build trust.

The onus is on you to build that trust with your leads and clients that will make them choose you and continue choosing you over other advisers. And you do that by showing them that you care through your content, campaigns, and other forms of communication.

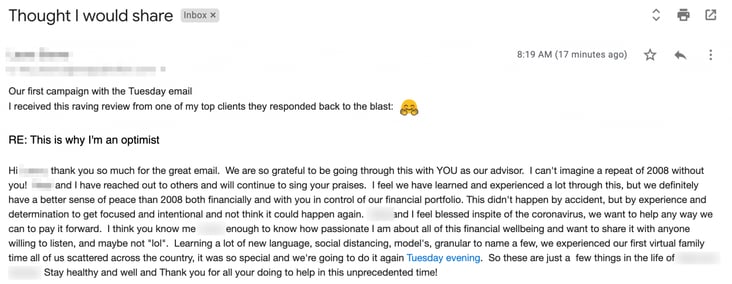

One way we’ve done that in the past year is through our end-of-year email: End of Year Wishes. The email lets our members say “thank you” to their clients for being with them through a tumultuous year. We did something similar last year, and our members got phenomenal responses from their long-time clients—all they needed to do was show empathy and care.

Telling your clients how much you care about them goes a long way—and you’ll learn more about them and how you can get them wins the more they share their lives with you.

Stay Away From Half-Baked Marketing Strategies With an Automated Growth Program

These three marketing ingredients work together to produce the perfect “peanut butter cookie”—a holistic strategy that gets you leads, turns those leads into clients, and encourages your clients to bring in referrals. If you don’t know where to start, we’ve got a solution for you 👇

Book a demo with us so we can assess your marketing and show you what you can do to get better results.

Book A Demo Today

Discover how Snappy Kraken helps advisors grow with a powerful marketing system

Request a demo