How Can Advisers Generate More Leads

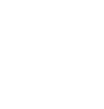

In our 2021 State of Digital Marketing Report, we found that our top 25% of highest-performing advisers, in terms of marketing, massively outperformed everyone else. They have more contacts, get better landing page conversion rates, and—most importantly— they generate more leads.

But our top advisers aren’t spending exponentially more money or time on their marketing than anyone else; they’ve just hit on some simple, effective strategies. We’ve compiled a list of what our top advisers are actually doing to help you build or adjust your own marketing strategy and get better results.

1. Run Multiple Campaigns on Multiple Platforms

A marketing campaign is a set of marketing materials with one consistent message promoted on different platforms. For example, a retirement campaign would contain a mix of social media posts, emails, videos, landing pages, and more—all about retirement.

Our top advisers run an average of 18 campaigns per year targeting different client and market segments. One of our members, Michael H. Baker of Vertex Capital Advisors®, chooses campaigns from the Snappy Kraken library that align with his goals. He told us: “We have automated campaigns running for our existing clients, 90-day onboarding email sequences, and slow-drip sequences for active or passive prospecting.”

Running campaigns on multiple platforms increases our top advisers’ visibility and helps them capitalize on the Mere Exposure Effect. The idea of the Mere Exposure Effect is that the more people see you, the more they begin to think of you as a reliable source, which is why our top advisers are active through email and on Facebook, LinkedIn, and Twitter.

“I think in today’s society, people just need to see things multiple times,” another member, Nolan Baker, founder of America’s Retirement Headquarters, said, “It’s just another layer to continue to be top of mind in a variety of different channels. I think it just increases the conversion ratios, probably by 25%.”

How you can do it

Figure out what campaigns you want to run based on your goals—lead generation, event promotion, lead nurturing, client nurturing, credibility building, or gathering testimonials.

After figuring out what you want to achieve, choose campaigns from the Snappy Kraken library that align with your goals.

2. Build Empathetic Content

Out top advisers know the power of empathy. They use stories, photos of their families, and anecdotes to show their leads and clients that they care and they understand.

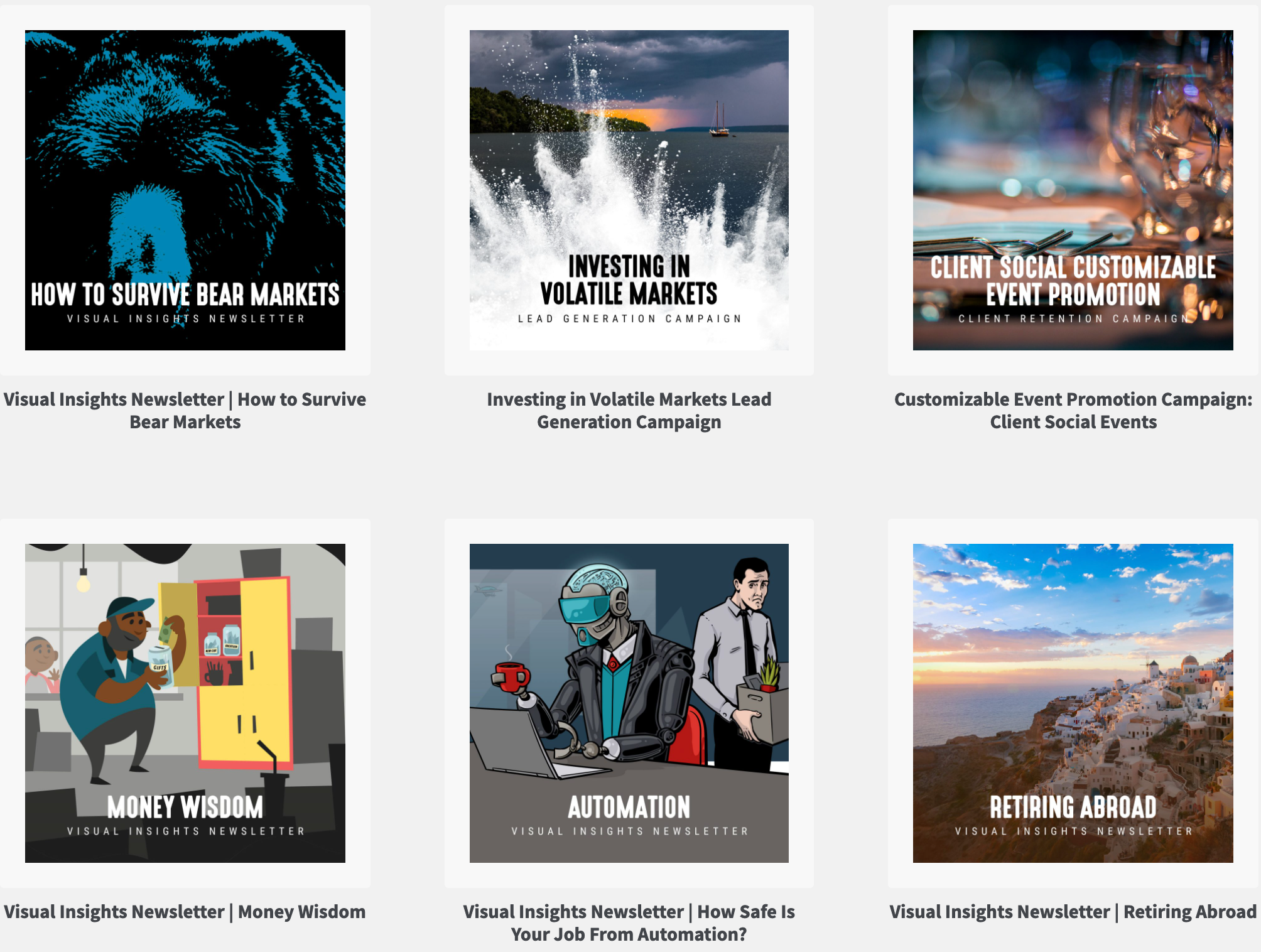

For example, one of our advisers decided to personalize his email in this way:

Right after introducing the email topic, this adviser decided to ask his clients a simple, “How are you doing? Are you and your loved ones safe?” which showed a tremendous amount of care during a time when COVID-19 lockdowns were at their all-time strictest.

He then goes on to attach a photo of a haggard-looking Matt Damon to add a little humor to the email. Empathy is a powerful tool. Show your clients that you care about them, and they’ll return the sentiment.

How you can do it

Being empathetic with your content means personalizing some parts of your content to show your human side. In your social media content and emails, post photos of your family, tell your leads how you’re feeling, and share some real, relatable stories that you think will make them connect with you.

3. Key in on Leads’ and Clients’ Interests

Your marketing content doesn’t have to all be dry financial advice; you can tie your expertise into your clients’ other interests. For example, we found out that most financial adviser clients are interested in celebrity and entertainment news, so we built a campaign on celebrity money mistakes that became one of our top-performing campaigns.

By understanding your clients, you can build better, more relatable content that will capture their interest. “We tag our clients based upon levels of interest,” Nolan said. “So, [we know which clients] are golfers or people who like to go to wine events or people who like a vacation.”

How you can do it

There are a couple of ways you can figure out what your leads and clients are interested in. For leads, keep track of what lead magnet they download. If one of your leads downloaded your guide to foreign tax credits, take note of that because that’s a hint at what they’re interested in. You can also run surveys asking people what they want to hear more about from you.

To get you started, we found out the average client’s top 10 affinities and interests:

4. Address Current Events and Concerns

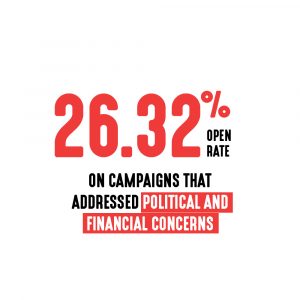

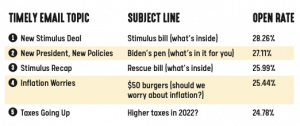

In our 2021 Half-Time Report, we found that campaigns that addressed political and financial concerns had an open rate of 26.32%, almost 4% higher than the average open rate of all our other emails.

Our advisers know how important it is to remain reliable, communicative, and current when the market is unpredictable. Eduard Hamamjian of GeaSphere LLC, another top adviser, asked us, “What’s the most difficult thing to do when you’re an advisor when markets collapse quickly? It’s reaching out and touching clients, making sure they know that you’re there, right? You don’t skip town because markets don’t go in the right direction.”

Clients rely on advisers to tell them what are the best moves when markets crash, taxes forms change or there’s talk of inflation. That communication and trust has helped our top advisers grow and build strong relationships with their clients.

“Snappy Kraken was consistently rolling out articles we could email out to our clients,” Nolan shared. “A lot of financial advisers struggled with COVID when it came out—our business experienced a 76% growth last year.”

How you can do it

Stay on top of the changes in the world that might make your clients worry about their financial state—political shifts, changes in the economy, etc. Then, address the things that might be worrying them with authority. Leave your emails open-ended so that your clients know that they can respond to you with their concerns if they have any. Doing so will help you learn more about them and address their needs better.

5. Segment Leads and Clients

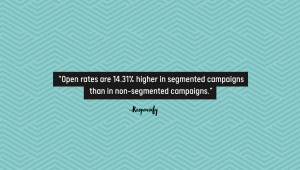

Your audience isn’t homogenous—each lead, prospect, and client is a real person with different interests, needs, and questions. As we’ve mentioned before, our top advisers know how important it is to keep track of each individual’s interests so they can send over relevant and relatable content.

Through segmentation, they can better classify their leads and clients’ interests from a personal and financial standpoint. Hannah Buschbom, another top adviser and financial advisor at The AmeriFlex Group, told us that she maintains her list on a monthly basis. “I spend three to four hours every month cleaning up my database, segmenting different contacts, and then actually launching the campaign.”

How you can do it

Segment your audience based on the lead magnets they download, the emails they interact with, and from information you’ve found out through conversations. You can do that easily through your Snappy Kraken dashboard.

You Can Be a Top Adviser, Too

Our top financial advisers get great results because they understand their audience better, genuinely want to provide value, and make themselves more accessible. You can be a top adviser, too, no matter where you are on your marketing journey.

Our Cold to Gold Framework was designed using research and data that we gathered from actual campaigns and emails sent by real advisers all across the United States. We’re sharing it with you so that you can get more results out of your marketing while saving both time and money.

Book A Demo Today

Discover how Snappy Kraken helps advisors grow with a powerful marketing system

Request a demo