[NEW] Single-Topic Email | Latest on Taxes

Capitol Hill is producing more drama than Hollywood.

We’ve got bold statements, ultimatums, cliff-hangers, and confusing sequels.

This timely email helps you reassure, educate, and build stronger connections with your clients during these uncertain times.

Use the simple message to offer clients and prospects your perspective on the current tax debate.

(It also talks about folks paddling up to Senators’ party boats to discuss tax reform 😂 )

The email discusses the two action items on the Biden “Build Back Better” agenda: The American Jobs Plan (which includes corporate tax increases) and the American Families Plan (which includes individual tax increases).

And let’s your contacts know:

- Neither plan in Congress looks close to passing in its current form, so nothing is set in stone yet.

- Retirement accounts may see new restrictions.

- Estate planning may get more complicated.

Make sure your contacts understand that the Bottom line is: Laws change. We adapt.

Lastly, it invites them to reach out if they have questions, concerns or would like to discuss this with you.

More about this campaign:

Title: Latest on Taxes

Type: Single-Topic Email/ Timely Emails

Description: Use this simple email to offer clients and prospects your perspective on the current tax debate.

Target Audience: Clients & Prospects

Primary Outcome/Action: Connect with clients and prospects important topics, such as tax debates, that impact many.

Running Time: Single email

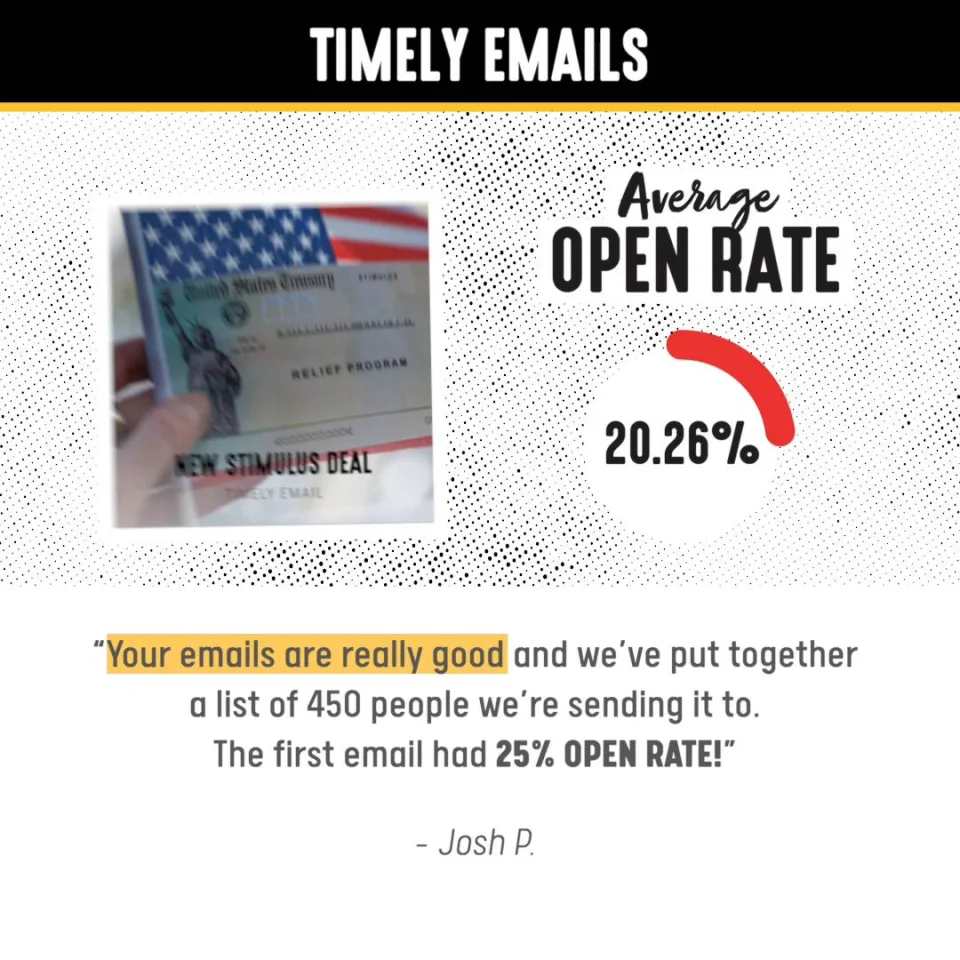

Timely emails present an easy, low-stakes way to maintain a relationship with your list of prospects and clients.

They make a difference!

Here are some of the results from our Weekly Crisis Emails that advisers used during the peak of COVID.

If you’re loving our Timely Emails, jump on our calendar to talk about what they (and our other award-winning campaigns) can do for your business by clicking here.

Book A Demo Today

Discover how Snappy Kraken helps advisors grow with a powerful marketing system

Request a demo