Maximizing ROI Of Social Ads For Financial Advisors

Social ads aren’t meant to get you instant clients.

In the same way that you don’t buy everything you see on social media, your target audience won’t sign a contract with every financial adviser who has an eye-catching ad.

Social ads are meant to grab attention, build brand awareness, and plant that seed that might someday bloom into a beautiful, loyal client.

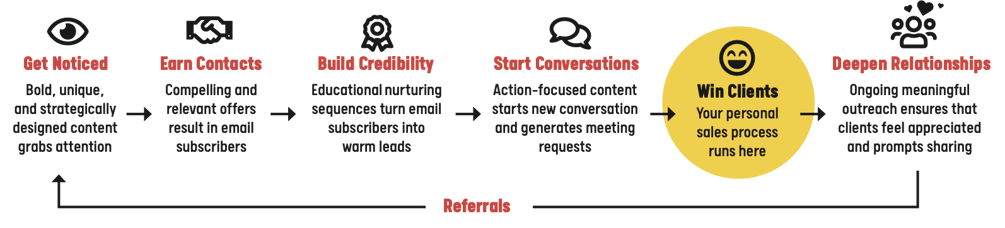

Effective social ads can get prospects halfway through our Cold to Gold Framework—from getting noticed to building credibility. Our Cold to Gold Framework has six steps: get noticed, earn contacts, build credibility, start conversations, win clients, and deepen relationships.

Our Cold to Gold Framework has six steps: get noticed, earn contacts, build credibility, start conversations, win clients, and deepen relationships.

The most successful advisers turn those leads into loyal clients by following up, starting conversations, and genuinely building trust and relationships.

Social Ads Get Your Foot in the Door

In 2020, 74% of advisers who used social media were able to start new relationships or onboard new clients within four months.

But there’s a catch: Those advisers used a holistic lead generation strategy—not just ads. And when they did run ads, they put their ads in front of eyes that they wouldn’t have been able to reach otherwise.

From our research and experience running almost 40,000 marketing campaigns, we’ve found that the best social ad campaigns have five characteristics:

- Realistic and specific goals: There are three types of social ad goals - awareness goals that aim to spread the word; consideration goals that aim to get you on your target audience’s minds; and conversion-related goals that aim to generate leads. An example of a great social ad goal is, “To increase Instagram followers to 500 and engagement rate to 10%.”

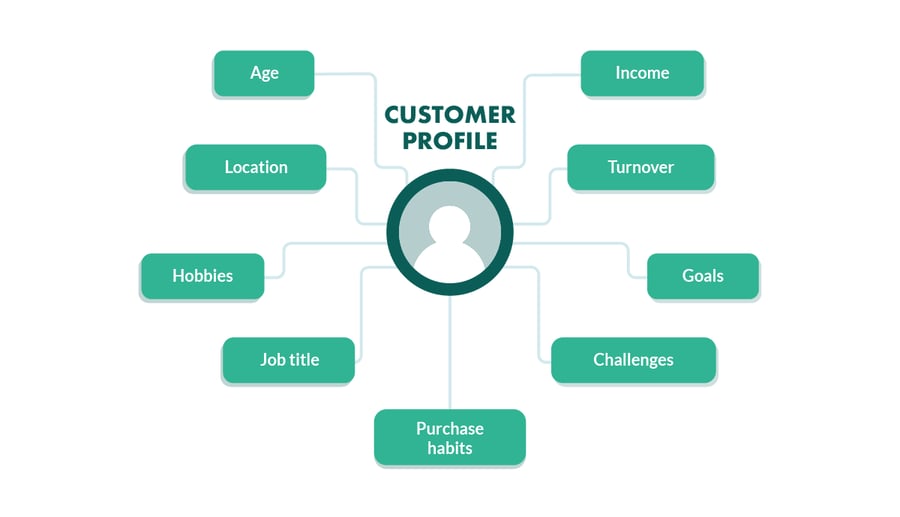

- Clearly defined target audiences: Building ads without a clearly defined target audience is like throwing darts blindfolded—you’ll be more successful if you open your eyes and aim. Talk to your existing clients to figure out who your target audience is (e.g., pre-retirees, new parents, working moms), what they’re interested in, and what their pain points are. Then, summarize your findings and build out a customer profile.

Client or customer profiles include specific information like age, location, hobbies, job title, purchase habits, income, turnover, goals, and challenges.

Client or customer profiles include specific information like age, location, hobbies, job title, purchase habits, income, turnover, goals, and challenges. - Graphics and copy that stop the scroll: When creating your ad content, make use of bold colors, compelling copy, and a catchy headline. Your target audience is probably inundated with all kinds of content every day—make your ads stand out by hitting their pain points and showing them that you can help.

- A call to action: Don’t leave your audiences thinking, “That’s nice, now what?” A call to action (CTA) tells your target audience exactly what they need to do after clicking your link. You can have different CTAs, but you need to make sure that your CTA aligns with your goals. If your goal is a bigger social media following, then your CTA needs to be “Follow me on Instagram,” not “Subscribe to my newsletter.”

- Relevant metrics to track success: Social ads get you short-term wins like more followers, comments, and messages. Celebrate those wins, but track metrics that are tied to your business growth. For example, increasing brand awareness will help you establish trust and boost word-of-mouth marketing—so track engagement rate and follower growth to find out if your social ads are making your brand more recognizable.

Remember, your ads aren’t magical—they won’t grow your business overnight. But if you optimize your campaigns and set yourself up for success, you’ll start to earn more contacts and establish yourself as the go-to adviser for financial concerns.

The Money Is in the Follow-Up

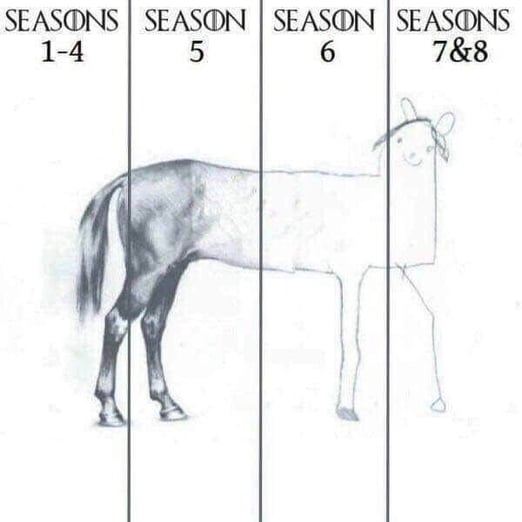

From 2011 to early 2019, Game of Thrones was one of the most relevant TV shows—even if you didn’t watch the show, you probably heard about it from a friend. But fans thought the last two seasons were so poorly planned and executed that the show completely disappeared from pop culture within months.

An illustration of how fans felt about the Game of Thrones series.

An illustration of how fans felt about the Game of Thrones series.

The same thing will happen to you if you run an amazing ad campaign and then drop all communications or offer a flimsy second act. Your leads will forget about you and turn to other advisers who show up more often.

You need to follow through if you want to convert your leads into clients.

Create Follow-Up Emails for Your Ad Campaigns

After someone interacts with your ad and downloads your lead magnet, send them a relevant follow-up email (or series of emails).

For example, one of our social ads is about retirement income. But the campaign doesn’t end after someone downloads the free guide. We have an automated email setup that tells the downloader how to get the most out of the free guide and encourages them to call or respond to the email.

This is the follow-up email for our campaign entitled The Retirement Income Teeter-Totter.

This is the follow-up email for our campaign entitled The Retirement Income Teeter-Totter.

The follow-up email not only adds value upfront but also brings you closer to your leads by reassuring them that you’re just a phone call or email away.

Stop Talking About Finance

Don’t flood your leads with financial content. Have a conversation.

Your leads and clients are real people with interests, hobbies, problems, and worries. Show them that you’re a real person, too, by telling them that you’re interested in things outside of finance and that certain events worry you, too.

Create finance-adjacent email campaigns that talk about:

- Political and economic shifts that might cause your leads and clients to worry about their portfolios and financial futures

- Your leads’ and clients’ interests and affinities like golfing, celebrity news, books

- Personal stories like work-from-home tales

Finance-adjacent content works well because it makes your campaigns more personally relevant to your readers. In fact, our best-performing campaigns of 2020 were finance-adjacent ones: “Creating Gratitude & Happiness,” “2020 Lessons Learned,” and “Financial Scams.”

All of them were related to finance in some way, but they were also interesting, engaging, and relatable.

Keep Nurturing—Even After Leads Become Clients

Leads become clients because they trust you and believe that you’re the best fit for their current financial needs. Continue to nurture your clients, increase that trust, and build your relationship to turn them from clients into advocates—i.e., your best source of new clients.

Financial adviser businesses get most of their new clients from referrals. Investopedia even goes as far as calling referrals to new clients the “lifeblood of the business.”

Create different types of email campaigns that your clients will find interesting:

- Educational campaigns that add value and show off what you know, like our Investing With Volatility campaign

- Video content that makes you more relatable and human, like our Gratitude campaign

- Invitations that tell your clients why you think they’ll be interested in an educational or nurturing event that you’re organizing

Continue adding value, and your clients will start generating new clients for you.

Get Access to Show-Stopping Content That Generates Leads and Turns Them Into Clients

We’ve got a whole library of plug-and-play content built specifically for you—a financial adviser who wants more results out of your marketing.

Our library helped Vertex Capital Advisers cut down their content creation time by 90% without sacrificing results. Vertex Founding Member Michael H. Baker said, “With Snappy Kraken’s support, we’re thriving as a business and living the life we want—which mirrors our approach to planning our clients’ retirement.”

In fact, they improved results and landed a high-net-worth (HNW) client as soon as they sent their first campaign!

Book a demo to see how you can achieve similar results.

Book A Demo Today

Discover how Snappy Kraken helps advisors grow with a powerful marketing system

Request a demo