[NEW] EOY Hidden Tax Opportunities - Prospect Engagement Campaign for Financial Advisors

For individuals with assets over $250,000, the clock is ticking. The end of the year is fast approaching, and with it, the expiration of numerous tax-saving opportunities. Many are unaware that these opportunities could be lost forever if not seized before December 31, 2023.

This campaign serves as your guidepost, revealing:

- Tax-saving tactics that even seasoned professionals might overlook

- Advanced strategies specifically tailored for people in their asset class

Prompt your prospects to act now by scheduling a complimentary, one-on-one Tax Opportunities Session before they file.

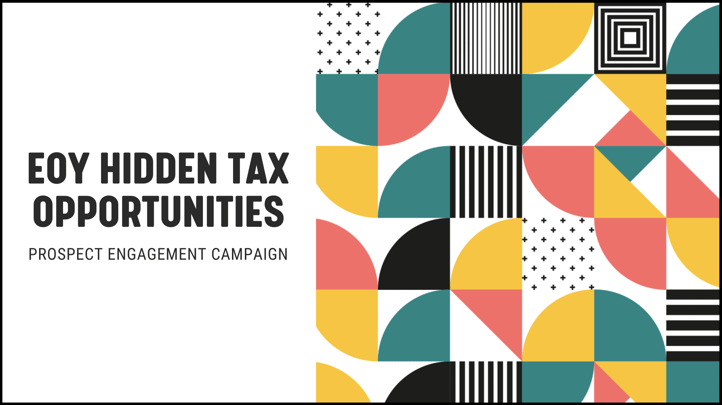

We help you continue the conversation with prospects, bringing them deeper into the awareness funnel, with emails that position you as the right source for help and offering a free appointment to discuss their financial questions. Prospects who have immediate needs are encouraged to request an appointment with you, bringing them right into your office.

The campaign publishes content over 4 weeks.

This campaign includes:

- 5 emails promoting the value of your advice

- 1 appointment page where motivated leads can request a free chat with you

- 1 appointment confirmation page that points leads to your website

- 1 appointment confirmation email that confirms the request was received

More About this Marketing Campaign:

Title: EOY Hidden Tax Opportunities

Type: Prospect Engagement Campaign

Description: Highlight the benefits of year-end tax optimization with this email-based campaign that educates, informs, and engages prospects on your list

Cold to Gold: Build credibility and start conversations

Target Audience: Prospects and taxpayers

Primary Outcome/Action: Booking an appointment

Running Time: 4 weeks

To find out more about how Snappy Kraken can fit into your marketing strategy, click here to see a demo.

Book A Demo Today

Discover how Snappy Kraken helps advisors grow with a powerful marketing system

Request a demo